All published articles of this journal are available on ScienceDirect.

Assessing Financial Condition of Municipal Sports Agencies: A Data Benchmarking Approach

Abstract

This study analyzes the development of the financial condition of local decentralized public sports services over a period of 10 years, obtaining benchmarks to serve as a point of reference. In order to do this, the elements of flexibility, independence, and sustainability are analyzed through three indicators in 2,139 observations obtained from municipal sports service organi-zations in Spain from 2002 to 2011. The majority of the organizations show results that are theoretically adequate in terms of flexibility and sustainability, but not independence. For this reason, the statistics presented can be used as a point of reference in order to classify the organizations in the sector according to their financial performance.

INTRODUCTION

Since the 1990s, local public services have gone through a process of adaptation and reform to increase the interest in the evaluations of results, efficiency, and effectiveness. This has been based primarily on the principles of New Public Management [1, 2]. In this process, the decentralization in autonomous organizational structures for each service and the adaptation of management styles and techniques from the private sector have been the key elements [3-8].

Among local public services, we can highlight the importance of sports services due to their large growth in the recent years [9]. Generally, local public sports services, in most of the European and South American countries, work to provide access to sports facilities and activities for all sectors of the population and to achieve the highest levels of physical activity possible in the said population [10]. In order to do this, they manage sports activities as well as their own sports facilities [9, 11, 12].

In Spain, municipal sports services make up the majority of public investment in sports, given that more than 90% of total public spending in this area is carried out through local administrations [13]. Furthermore, municipal sports are a pillar of sports in general, given that more than 80% of sports facilities are municipally owned [14]. In addition, more than 50% of the population that participates in sports and other similar physical activities does so in the aforementioned municipal sports facilities [15].

Local administration has shown great interest in utilizing performance measurement and tools such as benchmarking [6, 7]. This sort of techniques can be useful for fixing and assessing realistic objectives, promoting transparency, identifying opportunities and promoting the service improvement [16].

The management of sports services and facilities at the municipal level has also shown interest in performance measurement in areas such as accessibility, utilization, finance, and service quality [6, 8, 17, 18]. Specifically, recent events and the economic crisis have resulted in an increase in the importance placed on the financial aspects of the management of sports services at the local level [11, 19, 20]. However, the decentralization process of local governments has been developed faster than the incorporation of new management techniques such as performance measurement [4], fact that also occurs with the municipal sports services [19].

Thus, the objective of this study is to analyze the development of the financial condition of municipal sports agencies over a period of 10 years, obtaining benchmarks to serve as a point of reference and thereby allowing for the evaluation and positioning of these organizations in their sector.

Municipal Agencies and Sports Services

In the search of efficiency and quality in the public services, the local governments have opted for the externalization and decentralization [4, 21, 22]. In externalization or out-sourcing the municipal service management is assigned to a private sector entity. On contrary, in decentralization new smaller municipal entities are created. These entities are given greater autonomy, flexibility, customer orientation and business culture [23]. Through the externalization the municipal government has the ownership and control of the service. Meanwhile, the municipal government has the management of the services through a specialized agency with decentralization. The use of a system or another, as well as their combination, depends on the characteristics of the service and the context of each town or municipality.

For these reasons, the decentralization is one of the most important changes that the municipal governments have experienced. Concretely, we can denominate this process as a functional decentralization [4, 21, 24], or agencification [22, 25]; acquiring the same meaning in both cases. Decentralization is the creation of units to which the management and provision of specific services are transferred. For that purpose, the units have an independent budget and decision-making capacity [25], with specialized managers for each one of the services.

The different types of decentralized entities that we can found in Spain are the public firms, subjects to private law; public foundations that are regulated by foundations law; and, autonomous organizations, which depends on the same rules than municipal governments. Currently, municipal autonomous organizations are the most extended type of decentralized entity [24].

The Local Government Act (LRBRL), modified at the end of 2013, (via the Law of rationalization and sustainability of the local government), defines a set of specific competencies of the Spanish municipalities, which are related to the services that they must provide. These competencies include the "promotion of sport and sports facilities". Therefore, sport management has a great importance in the municipal context. In this way, the municipal sports services of most of the cities are managed by municipal agencies, and particularly through the figure of municipal autonomous organizations [14]. This functional decentralization facilitates the introduction of performance measurement techniques, which are considered of great importance for the modernization of municipal services [6] and sports services [19].

To achieve their objectives, municipal sports agencies depend on both, public funding resources and economic resources that arise from their activity in the form of fees paid by the users of the service. However, given the current economic situation, these organizations have been obliged to improve their efficiency [11], increase returns and improve their budget and financial performance [19]. Moreover, the new revision of the LRBRL, which started in January 2014, specifies that municipal services could be intervened by supramunicipal government if they fail to manage efficiently the available resources and impose severe penalizations to the municipal governments and their agencies if they keep an unbalanced budget.

Financial Condition and Data Benchmarking

The financial condition has become extremely important in the economic management of the public sector, given that it is considered to be a good way of measuring financial performance at the local level [26, 27]. Although a number of definitions exist, the financial condition is generally understood as the ability to adequately provide services to meet current as well as future obligations [28].

A single system for evaluating the financial condition does not exist [27], and for this reason it is necessary to adapt the indicators to the characteristics and information that organizations have available [29]. Simplicity and usefulness are key elements to doing this successfully [5]. In this sense, various works have made proposals for classifying the indicators that make up the financial evaluation into different elements [22, 26, 27, 30-33], with the objective of achieving a more comprehensive measurement.

Specifically, the financial condition can be measured through a series of indicators related to budgetary solvency, taking into account the flexibility, vulnerability, and sustainability [31, 34, 35]. Flexibility is related to the capacity of the organization to confront change. Vulnerability, or independence, is the level of dependency on external resources. Lastly, sustainability measures the capacity of the organization to maintain its activities without incurring a deficit [27]. Since the municipal autonomous organizations have their own independent budgets, this approach is suitable to measure their financial condition.

However, knowing the result of an indicator related to the financial condition at one point in time provides limited information [36]. In order to carry out the correct interpretation, it is necessary to analyze the indicator over time and look for data and reference benchmarks in order to act in the present [18, 37]. A benchmark can be defined as “a value for a performance indicator, which is a reference point of comparison” [17]. The comparison of data from the sector will facilitate the evaluation of the results by allowing performance to be measured in a relative form [6, 12], thus making it easier to set challenging and achievable targets and encourage evidence-based decision making [18, 37].

To make it possible, there are two types of benchmarking: data benchmarking [38, 39] define (making quantitative comparisons and establishing a grading system in order to set targets and monitor progress) and process benchmarking (selecting other organizations as references points in order to compare the processes and acquire new strategies in order to improve performance). Consequently, the success of benchmarking depends on first analyzing the sector in order to evaluate the results of the organization and subsequently looking at other organizations to acquire new practices [5, 37, 38].

METHODOLOGY

Sample

The objects of the study are decentralized entities of municipal sports services (municipal sports agencies). We define local decentralized organizations as those organizations with autonomous organizational structures and autonomous management with independent budgets and accounting [4]. We selected a sample group of municipal autonomous organizations that provide sports services to populations of 1,000 inhabitants or greater in Spain, for the period of 2002 to 2011. The sample group varied between 194 and 225 organizations according to the year and a total of 2,139 observations were made. All data for each organization were obtained from the Spanish Ministry of Treasury and Public Administration. All organizations that presented complete information sufficient for calculating the indicators were used. The data were audited in various phases before being included in the database. This type of data gathering is used in practically all scientific literature that analyzes financial variables at the municipal level with large sample groups.

We delimited the gathering of the data to this sample group, given that the individual budgets of all organizations are adhered to the same standard regulations, thus allowing for comparability. Nevertheless, it is possible to extrapolate the results from this study to other local organizations with independent budgets in the area of sports services.

Performance Indicators

In order to establish the indicators, we opted to apply a budgetary solvency approach, using a key indicator for each of the selected elements that constitute the financial condition (flexibility, independence, and sustainability). We used indicators previously applied in other studies that measured financial performance [22, 27, 30, 31, 33]. Likewise, we added the indicator of Current Expenditures per capita due to its strong relevance for management and control by the public administration [40]. The indicators can be seen in (Table 1).

Description of the indicators analyzed.

| Element | Indicator | Definition | Relationship with Financial Condition |

|---|---|---|---|

| Flexibility | Net Saving Index per capita | Difference between current budgetary receivables and current budgetary payables, annual amortization payment (per inhabitant) | The higher the value, the better is the financial condition |

| Independence | Self-Financing | Current budgetary receivables except current grants divided by current budgetary payables except current grants and interest payment | The higher the value, the better is the financial condition |

| Sustainability | Non-Financial Budgetary Result Index | Current budgetary payables, non-financial capital budgetary payables divided by current budgetary receivables, non-financial capital budgetary receivables | The lower the value, the better is the financial condition |

| Other | Current Expenditures per capita | Current budgetary payables per inhabitant | Complementary indicator |

We measured flexibility through the Net Saving Index per capita [22, 31, 33]. Using this indicator makes it possible to know if the entity is funding current expenditures by incomes obtained through capital operations or via debt, or on the contrary, has additional incomes to finance part of the new investment. Therefore, a higher value indicates higher flexibility; and a result above 0 will mean a positive Net Saving Index.

To assess financial independence, we used the indicator called Self-Financing. This indicator is the financial performance measure most used by municipal sports organizations in Spain [41]. Its aim is to calculate the extent to which an entity is financing its current expenditures through incomes generated by its own activities and, therefore, reflects dependence on external resources obtained from intergovernmental transfers. Thus, the higher the value, the higher is independence. In this way, it is common for municipal sports agencies set a 50% self-financing as a reference result.

Finally, we selected the Non-Financial Budgetary Result Index as the indicator related to sustainability because this is used in the most recent literature on the financial condition [22, 31, 33]. The results show the Euros spent for each Euro received, and a value below 1 will affect nonfinancial surplus. Therefore, a lower value for the indicator is related to higher sustainability and thus a better financial condition.

The indicators expressed in Euros per capita (Net Saving Index per capita and Current Expenditures per capita) were adjusted to the Consumer Price Index for the base year of 2011 so that it was possible to work in real terms.

Data Analysis

The analysis of data was performed by using the Software Stata version 11 and Software SPSS version 20. Firstly, the relationship between the indicators calculated was studied by means of a correlation analysis. This analysis allows the evaluation of feasibility and validity of the indicators selected to be a model to measure the financial condition [26].

Afterwards, a descriptive statistical analysis was carried out for all the variables that make up the model of the financial condition for each year and for the sample group as a whole (whole period). The coefficient of variation (CV) was also added in order to complement the standard deviation. Subsequently, the 25th, 50th, and 75th percentiles were calculated for each of the indicators for every year and for the whole period, following the routine procedure to establish benchmarks in local governments [27, 29] and sports facilities [12, 17, 18, 37].

Furthermore, the percentage of organizations that were considered to be adequate, with respect to the whole sample group, according to the definitions of each indicator, was also calculated. Specifically, the Net Saving Index per capita is theoretically adequate with a result that is equal to or higher than 0. In Self-Financing, a result higher than 0.50 is considered to be adequate, while in the Non-Financial Budgetary Result Index, a result of 1 or less is considered to be adequate.

Finally, the changes from year to year and development of the financial condition were analyzed through an ANOVA test, using a polynomial contrast in order to see the possible trends between 2002 and 2011, in the same way as Liu [37] and Liu et al. [12]. Bonferroni post-hoc comparisons were also carried out in order to analyze the possible differences between each of the years studied. Statistical significance was established at p < 0.05 in all cases.

RESULTS

Relationships Between Indicators

Table 2 shows the results of the correlations between the indicators analyzed in the whole period.

All the correlations between the three key indicators are significant. Nevertheless, the value of the coefficients in the majority of results is very small, showing very weak correlations. Only the correlation between the Net Saving Index per capita and the Non-Financial Budgetary Result Index stands out (r = -0.412, p < 0.001), while the Self-Financing indicator is the most independent.

Correlations between the four indicators (whole period).

| NSIPC | SF | NFBRI | CEPC | |

|---|---|---|---|---|

| NSIPC | 1.000 | |||

| SF | 0.099* | 1.000 | ||

| NFBRI | -0.412* | -0.085* | 1.000 | |

| CEPC | 0.211* | 0.128* | -0.007 | 1.000 |

Financial Condition of Municipal Sport Agencies

The main results can be observed in Table 3, which shows the descriptive statistics and calculated percentiles for each indicator, year by year, and for the whole period.

Descriptive statistics, benchmarks and ANOVA results.

| Net Saving Index Per Capita | Self-Financing | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| p25 | p50 | p75 | % | mean | sd | CV | ANOVA | p25 | p50 | p75 | % | mean | sd | CV | ANOVA | |

| 2002 | -0.369 | 0.539 | 2.178 | 66.667 | 1.219 | 5.126 | n.a. | F = 1.346 p = 0.208 | 0.182 | 0.306 | 0.460 | 21.622 | 0.355 | 0.272 | 0.767 | F = 1.204 p = 0.288 |

| 2003 | -0.426 | 0.797 | 1.961 | 68.041 | 0.855 | 5.914 | n.a. | 0.176 | 0.278 | 0.462 | 22.165 | 0.352 | 0.283 | 0.803 | ||

| 2004 | -0.536 | 0.694 | 2.323 | 64.840 | 1.111 | 5.079 | n.a. | 0.173 | 0.295 | 0.477 | 21.005 | 0.353 | 0.274 | 0.778 | ||

| 2005 | -0.032 | 0.699 | 2.360 | 73.934 | 1.767 | 6.467 | n.a. | 0.169 | 0.284 | 0.441 | 19.431 | 0.325 | 0.233 | 0.717 | ||

| 2006 | -0.135 | 0.799 | 2.375 | 70.142 | 1.086 | 6.989 | n.a. | 0.173 | 0.285 | 0.455 | 19.905 | 0.325 | 0.228 | 0.702 | ||

| 2007 | -0.481 | 0.700 | 2.793 | 67.111 | 2.221 | 7.660 | n.a. | 0.175 | 0.264 | 0.432 | 17.333 | 0.316 | 0.222 | 0.702 | ||

| 2008 | -0.851 | 0.546 | 2.608 | 64.186 | 0.872 | 5.063 | n.a. | 0.187 | 0.265 | 0.412 | 17.674 | 0.317 | 0.211 | 0.666 | ||

| 2009 | -0.383 | 0.616 | 3.053 | 69.484 | 1.207 | 6.480 | n.a. | 0.183 | 0.283 | 0.448 | 20.657 | 0.326 | 0.212 | 0.650 | ||

| 2010 | -0.713 | 0.585 | 3.083 | 64.384 | 1.424 | 6.038 | n.a. | 0.188 | 0.303 | 0.484 | 23.288 | 0.362 | 0.298 | 0.822 | ||

| 2011 | -1.070 | 0.385 | 2.144 | 63.333 | 0.520 | 6.118 | n.a. | 0.193 | 0.304 | 0.486 | 24.286 | 0.358 | 0.239 | 0.667 | ||

| WP | -0.450 | 0.636 | 2.388 | 67.181 | 1.237 | 6.155 | n.a. | 0.178 | 0.287 | 0.453 | 20.711 | 0.339 | 0.249 | 0.735 | ||

| Non-Financial Budgetary Result Index | Current Expenditures per capita | |||||||||||||||

| p25 | p50 | p75 | % | mean | sd | CV | ANOVA | p25 | p50 | p75 | % | mean | sd | CV | ANOVA | |

| 2002 | 1.039 | 0.993 | 0.964 | 57.658 | 1.016 | 0.140 | 0.137 | F = 2.398 p = 0.010 | 19.586 | 30.775 | 43.896 | n.a. | 36.890 | 28.074 | 0.761 | F = 4.130 p < 0.001 |

| 2003 | 1.034 | 0.997 | 0.958 | 55.155 | 1.004 | 0.120 | 0.120 | 19.909 | 31.508 | 44.290 | n.a. | 36.067 | 24.111 | 0.669 | ||

| 2004 | 1.034 | 0.998 | 0.955 | 56.164 | 1.008 | 0.126 | 0.125 | 21.285 | 34.266 | 51.476 | n.a. | 41.031 | 34.859 | 0.850 | ||

| 2005 | 1.018 | 0.991 | 0.942 | 63.981 | 0.993 | 0.150 | 0.151 | 21.270 | 34.705 | 50.609 | n.a. | 41.474 | 33.336 | 0.804 | ||

| 2006 | 1.022 | 0.991 | 0.946 | 62.085 | 0.987 | 0.104 | 0.105 | 23.393 | 36.848 | 54.987 | n.a. | 44.392 | 38.325 | 0.863 | ||

| 2007 | 1.024 | 0.993 | 0.947 | 61.778 | 0.984 | 0.123 | 0.125 | 25.253 | 40.312 | 61.266 | n.a. | 47.299 | 37.213 | 0.787 | ||

| 2008 | 1.045 | 0.998 | 0.950 | 53.953 | 1.008 | 0.133 | 0.132 | 25.212 | 41.498 | 63.919 | n.a. | 49.620 | 38.797 | 0.782 | ||

| 2009 | 1.032 | 0.998 | 0.955 | 55.399 | 1.015 | 0.173 | 0.171 | 27.277 | 41.991 | 63.150 | n.a. | 50.413 | 40.126 | 0.796 | ||

| 2010 | 1.034 | 0.999 | 0.959 | 52.511 | 1.000 | 0.126 | 0.126 | 25.357 | 39.528 | 58.654 | n.a. | 48.386 | 44.188 | 0.913 | ||

| 2011 | 1.056 | 1.000 | 0.970 | 52.857 | 1.032 | 0.171 | 0.165 | 23.440 | 38.555 | 57.126 | n.a. | 47.147 | 44.656 | 0.947 | ||

| WP | 1.032 | 0.996 | 0.955 | 57.176 | 1.005 | 0.139 | 0.138 | 23.010 | 36.905 | 55.800 | n.a. | 44.337 | 37.208 | 0.839 | ||

The Net Saving Index per capita shows that the majority of municipal sports agencies have good results. Observing the whole period, more than 65% of the observations have results of 0 or higher, and consequently a positive Net Saving Index per capita, giving them flexibility to take on new expenses. Likewise, the 50th percentile is also positive in all the years analyzed, and the 75th percentile indicates that 25% of the organizations analyzed have a Net Saving Index per capita above €2.00 per inhabitant (except in 2003, whose result was €1.961 per inhabitant).

The next indicator with the best results in the whole period is the Non-Financial Budgetary Result Index. More than 50% of the organizations analyzed have a value of less than 1 and, therefore, show a surplus in their budgetary results. It should be noted that in the whole period this percentage is above 55%. Likewise, the results of the 50th percentile are very close to 1, although always equal to or below that number (the best result was 0.991 in 2005 and 2006). It should be remembered that a value closer to 0 in this indicator corresponds to a larger surplus and a better financial condition.

In contrast to the previous indicators, Self-Financing has very low values in general, and for all years it was never greater than 0.50 (50%) at the 75th percentile, with results near to 0.45. The 50th percentile shows values near to 0.30, with 0.287 in the whole period. Likewise, the average shows values between 0.30 and 0.40 for every year and in the whole period.

The indicator of Current Expenditures per capita was also analyzed. The 50th percentile shows values between €30 and €42 per capita in each year and €36.905 for the whole period. The average shows higher values, between €36 and €51 per capita.

Lastly, the CV shows that the indicators of Self-Financing and Current Expenditures per capita have greater variability, with values of 0.735 in the whole period for Self-Financing and of 0.839 for Current Expenditures per capita. Further, it should be highlighted that when analyzed from year to year, the Current Expenditures per capita indicator has the highest values, with a CV above 0.90 in 2010 and 2011. On the other hand, the Non-Financial Budgetary Result Index shows less variability, with values that vary between 0.12 and 0.17 when analyzed year by year, and 0.139 in the whole period.

Development of the Financial Condition

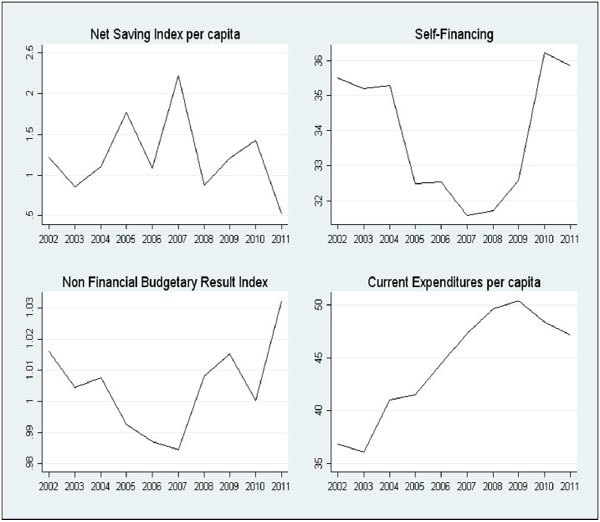

The results of the ANOVA test can be observed in the last column of each indicator in Table 3, where the F value appears along with the level of significance. Likewise, in Fig. (1) the averages of each indicator are graphed, contrasting the results obtained from the polynomial analysis.

Graphs of the development of the average in each of the indicators.

The Net Saving Index per capita does not show any significant differences in the ANOVA test or in the post-hoc analysis, where the differences between each pair of years are examined. Moreover, no significant trend is seen in the polynomial contrast either.

Just as seen with the Net Saving Index per capita, Self-Financing also does not show significant differences in the ANOVA test or in the post-hoc comparisons. There is also no significant linear trend (F = 0.044; p = 0.833). However, it does show a significant quadratic trend (F = 7.679; p = 0.006). Self-Financing declines from 2002 to 2007 and rises from 2007 to 2010. In 2011, there is a slight drop, but it is not sufficient to rule out a significant quadratic trend.

Table 3 shows the significant differences in the Non-Financial Budgetary Result Index. The post-hoc comparisons show that the average in 2011 has a value significantly greater than that in 2006 and 2007, which represent the lowest values (p = 0.036 and p = 0.013, respectively). Taking into account the interpretation of this indicator, the post-hoc comparison indicates the existence of better results in 2006 and 2007 compared with 2011, which shows the worst results. Furthermore, the polynomial contrast does not show a significant linear trend (F = 1.349; p = 0.246), but it does show a significant quadratic trend (F = 12.965; p < 0.001). In general, the average value lowers from 2002 to 2007 and rises from 2007 to 2011, showing that the Financial Budgetary Result Index worsens from 2007 onward.

Lastly, Current Expenditures per capita also show significant values in the ANOVA test. The post-hoc comparisons indicate that the average value in 2002 is significantly lower than that in 2008 and 2009 (p = 0.015 and p = 0.006, respectively), and that the average in 2003 is significantly less than that in 2008, 2009, and 2010 (p = 0.010, p = 0.004, and p = 0.033, respectively). Furthermore, a significant linear trend can be seen (F = 30.132; p < 0.001) as well as a significant quadratic trend (F = 4.065; p = 0.044). Nevertheless, looking at Fig. (1) and the values of statistical significance, the data seem to adjust better to a linear relationship. The data show growth in Current Expenditures per capita from 2002 to 2009 and a decline in the last two years analyzed, 2010 and 2011.

DISCUSSION

Although financial performance evaluation is of great relevance to the management of municipal sports service organizations, there is limited information about measuring the financial condition, sector results, and development of these organizations. The results of this study allow for the advancement of knowledge about the financial condition of these organizations, with implications that are discussed below.

The associations between the three key indicators show significant values. A positive correlation is always seen, except when one of the variables is the Non-Financial Budgetary Result Index. However, keeping in mind that a lower value for this indicator is related to a better financial condition, it can be corroborated that a better result in one of the indicators is related to a better result in the rest of them.

Coinciding with Wang et al. [26], the results obtained show that the indicators measure the same concept of the financial condition as a whole. Therefore, it can be affirmed that the indicators selected are compatible and may be used to measure financial performance for these organizations.

Specifically, while the Non-Financial Budgetary Result Index has a moderate association with the Net Saving Index per capita, the Self-Financing indicator has a very weak association with both these indicators. Therefore, measuring the financial condition through different elements and indicators becomes especially relevant, given that it allows for an independent control in the search for better financial performance in general.

More than 50% of the organizations show theoretically good results in the Net Saving Index per capita and in the Non-Financial Budgetary Result Index. This finding means that there is a positive Net Saving Index per capita and a surplus in the Non-Financial Budgetary Result Index for the majority of local autonomous sports service organizations. However, the majority show theoretically poor results in Self-Financing. Coinciding with Liu [37], the fixed standards without clear evidence cannot thus be a realistic reference for the assessment.

The statistical data presented allow us to classify objectively the results as adequate or inadequate compared with standard theories. As mentioned by Navarro-Galera et al. [6], comparing indicators allows for measuring performance in a relative manner. In the case of Self-Financing, despite the fact that the desired result is close to 1 (100% Self-Financing) and theoretically correct at 0.50 (50% of Self-Financing), a result over 0.30 can be considered to be good for the sector and over 0.45 one of the best financial performers in this aspect. Therefore, the presented data evidence that municipal sports agencies barely produce incomes as a result of their own activities. For that reason, their main finances usually come from external grants.

Likewise, in the case of the Net Saving Index per capita, a positive result is adequate; however, a challenging target for the sector should be above €0.50 per capita. This is distinct from the Non-Financial Budgetary Result Index, where a theoretically adequate result corresponds to the statistical results obtained in the study, given that, in general, it is possible to deduce that an organization with a result minimally inferior to 1 will be in the top 50%.

Furthermore, the different organizations can evaluate their results over the 10-year period analyzed in a relative manner due to the percentiles presented, thus checking their position in the sector. In agreement with Rivenbark and Roenigk [32], they can evaluate the success of their strategies with respect to other organizations, more effectively taking into account their financial position in order to improve performance. In this sense, and in agreement with Liu [5], each organization should select similar organizations that have results close to those they wish to achieve, with the objective of acquiring new practices and transferring data to the benchmarking process. Nevertheless, as Taylor and Godfrey [18] conclude, the availability of quantitative data on performance facilitates management and planning based on this evidence.

Regarding the development of the indicators analyzed, a U-shaped trend is found for Self-Financing and the Non-Financial Budgetary Result Index. While Self-Financing shows a decline in its results until 2007 and then a subsequent improvement, the Non-Financial Budgetary Result Index shows the opposite results, with a rise until 2007 (we have to take into account that a higher value in the Non-Financial Budgetary Result Index is related to lower sustainability). The economic crisis, whose beginnings can be dated to between 2007 and 2008 [20], could be related to this event, given that monetary transfers from other public administrations to municipal sports services decreased [19], resulting in worse results for the Non-Financial Budgetary Result Index. As a result, the management of local services has needed to increase Self-Financing and reduce dependence on external resources.

The analysis of Current Expenditures per capita indicates that it followed a clear linear trend until 2009, suffering a decline afterwards in the last two years analyzed (2010 and 2011). In order to correctly interpret these data, as noted by Zafra-Gómez et al. [27], having a greater value for the indicator based on spending per inhabitant as an element of the financial condition can be related to a greater offering of services or, on the contrary, inefficiency. For this reason, it has not been established if a greater value in this indicator corresponds to a better or worse financial condition. Nevertheless, due to its great importance in studies that analyze the economic aspects of local administration [40], this indicator was used as a complementary measure to the elements proposed to evaluate the financial condition.

CONCLUSION

The present study proposes a way of evaluating the financial performance of municipal sports agencies through indicators related to their financial condition. Taking Spain as an example, statistical data are presented and point of reference have been established. These results can be used in order to evaluate the financial performance of these organizations in a relative manner, based on their position in the sector.

These data were analyzed over a 10-year period and with a general value for the whole period, thus permitting them to be used to evaluate the development of the organizations in their sector, highlighting results that may be of reference in order to set and track targets. The analysis of trends further facilitates the possibility of contrasting the evolution of the financial condition with respect to the sector. In this sense, the results of the study demonstrate that theoretical standards are insufficient when it comes to cataloging the results of the public service organizations analyzed. The majority of the organizations show results that are theoretically adequate in terms of flexibility and sustainability, but not independence.

Lastly, the possibility stands out of adding more indicators and new elements proposed by other authors in order to improve the analysis of the financial condition of these types of services as a challenge for future research.

CONFLICT OF INTEREST

The authors confirm that this article content has no conflict of interest.

ACKNOWLEDGeMENTS

Declared none.